Simple Ira Contribution Limits 2024 Catch Up. Anyone age 50 or over is eligible for an additional catch. If the employee is at least.

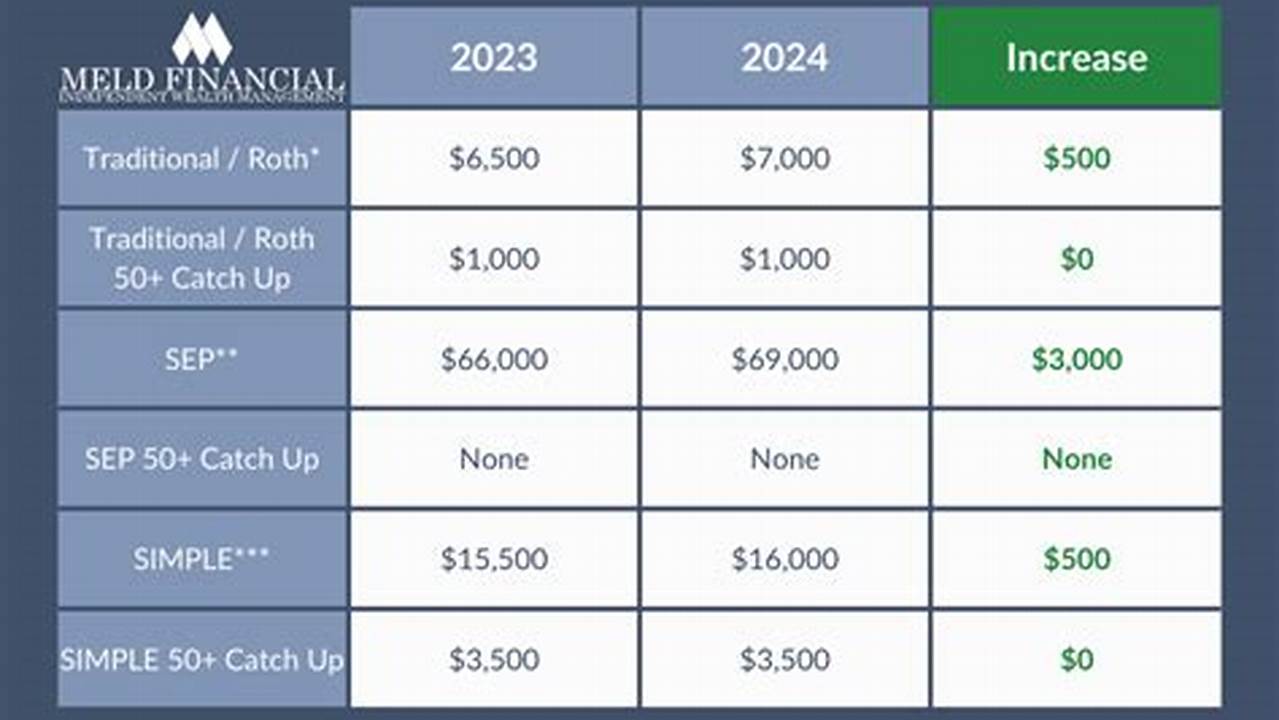

That’s up from the 2023 limit of $15,500. For plan years beginning after dec.

Basics Of Simple Iras Simple Ira Contribution Limits For 2024 Simple Ira Contribution Deadlines.

The 401 (k) contribution limits in 2024 have increased for employees to $23,000.

Get Any Financial Question Answered.

The salary deferral contribution may not exceed the employee’s compensation and is capped at $22,500 for 2023.

The Ira Contribution Limit Is $7,000 In 2024.

Images References :

The Ira Contribution Limits For 2023 Are $6,500 For Those Under Age 50 And $7,500 For Those 50 And Older.

Basics of simple iras simple ira contribution limits for 2024 simple ira contribution deadlines.

The Internal Revenue Service Sets Maximum Annual Contribution Levels For Iras Every Year.

In 2023, simple iras allow for employee contributions up to $15,500 annually ($19,000 for those 50 or older);

That's Up From The 2023 Limit Of $15,500.